For those of you who are in the DropShipping or POD business or you are simply doing MMO, international money transfer will be one of the problems that you need to solve. However, this can be difficult for you, such as time consuming, expensive, cumbersome and ineffective. But don't worry, that all changes with Wise (formerly known as TransferWise). Wise is an online platform that makes sending and receiving money internationally easy, transparent and economical. In this article, PlutusPay writes a comprehensive review of Wise.

Illustration of Wise

What is Wise? What are the salient features of Wise?

- Wise, formerly TransferWise, is an international money transfer service.

- You can easily open an account and make money transfers.

- There are competitive exchange rates and no foreign currency arbitrage fees

- There are low transfer fees.

- Wise Cost Calculator help you see rates and fees transparently

- Can send money to more than 80 countries.

- A well-informed FAQ page comes with a good support team – However, phone support is only available during office hours.

- Money transfers can be fast or slow depending on the type of service.

- Fast money transfers are possible using a debit or credit card.

- Transferring funds from a bank account can take several days.

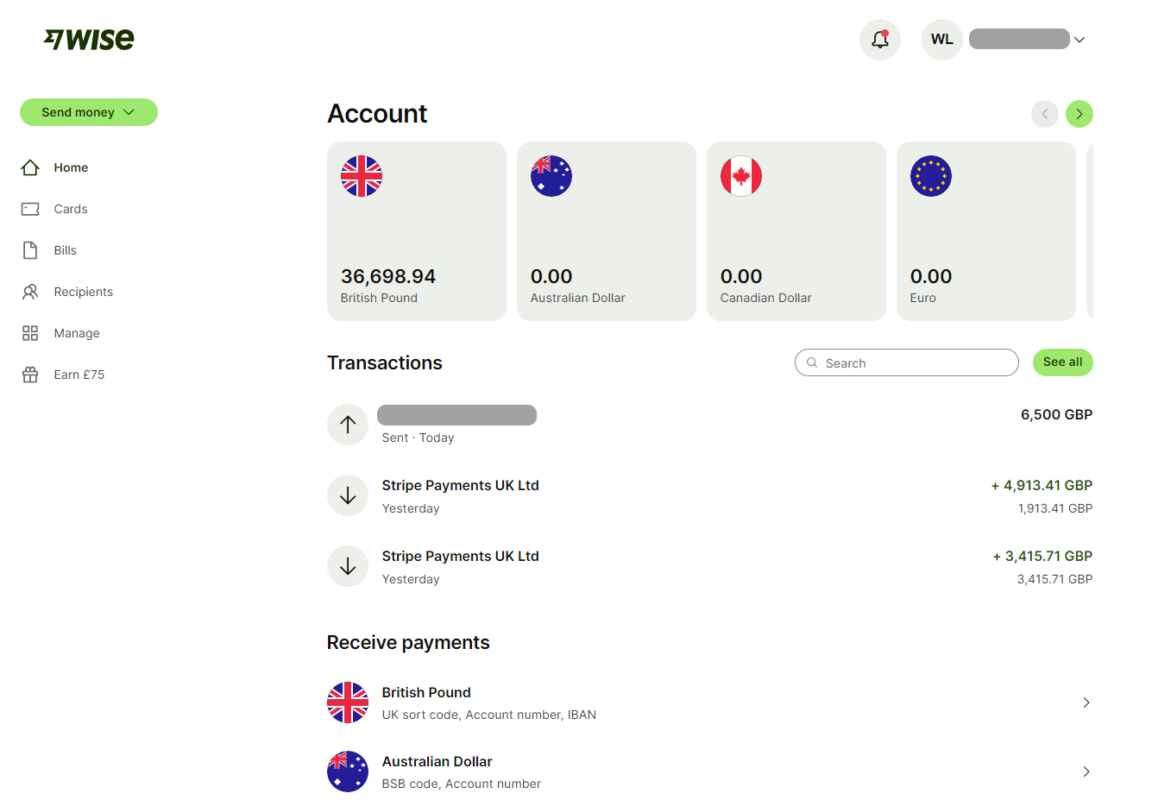

Dashboard of Wise on the computer

Is Wise a good choice for international money transfers?

In short, that's right. Wise is an excellent choice for sending money internationally.

International money transfer accounts for one of the main reasons customers complain when using banking services. Banks and intermediaries often charge high fees when sending and receiving money from different countries.

Pros and cons of Wise

Advantage:

- There are different money transfer options

- No exchange rate difference fees

- Fast money transfer

Defect:

- Higher remittance fees than some competitors

- No cash transaction option

- Customer support is quite limited at times

How Wise works?

Wise was created in 2011 in the United Kingdom. Wise acts as a financial institution for sending money internationally.

After you create an account and log in, you can transfer money right away. You just need to choose the currency and amount you want to send, as well as the currency you want to convert to, and Wise will provide the best exchange rate at that time along with the transfer fee.

Key features of Wise

Wise offers a wide range of features that cater to both businesses and individuals. Here's a list of Wise's top features:

-

Low fees:

Wise currently offers the lowest fees in the industry, making them a cost-effective choice for those of you who frequently have to transfer money internationally.

-

Transparent exchange rate:

Wise provides its clients with the average exchange rate, which is the actual exchange rate at which currencies are being traded in the global market. The platform does not charge any other hidden fees or arbitrage fees.

-

Cross-border money transfer

Wise accounts are not limited to 1 currency, so you can receive and manage 50 different currencies. This makes it easier to send, receive and spend money.

-

Debit card (debit):

Wise has a debit card that connects to your account, allowing you to withdraw money from ATMs and use funds of different currencies without any hidden fees.

Wise's Debit Card

-

Multi-currency transfer:

Allows you to transfer money in more than 70 currencies, so Wise is the ideal platform for businesses and individuals wishing to transfer money internationally.

-

Integration with popular payment applications:

Wise already has integrations with popular payment apps like Venmo and Google Pay, allowing customers to easily send and receive money across borders.

-

Fast money transfer:

Coupled with a fast money transfer service, most transactions take only a few hours to complete.

-

Reliable:

Wise is a trusted name in the industry, with over 10 million customers worldwide and a history of providing reliable and secure service.

-

Dedicated customer support:

Wise has a dedicated customer support service, Wise Support Channels are available in multiple languages and through a variety of channels, including email, phone and live chat.

Advantages of Wise:

Wise has made the process of sending money abroad to friends and family quick and stable. Here are the benefits of this platform:

-

Safe when using:

Wise is an electronic financial institution licensed and regulated by the Financial Administration (FCA) and the Royal Revenue and Customs Authority (HMRC) in the United Kingdom. Both of these organizations provide organization-level security and encryption (256-bit SSL data with 2048-bit key) for Wise.

In addition, funds in individual customer accounts are always kept separate from corporate accounts. In the event of Wise experiencing financial difficulty or bankruptcy, the client's funds will always be safe.

Money transfers are notified via email and the Wise mobile app to ensure transparency and security. It is also possible to receive money through Wise even if the recipient does not have a Wise account.

-

Low exchange rate

Typically, the Actual Market Rate for currency conversion is averaged from the buy and sell rates of a particular currency. The actual exchange rate will always change continuously.

Wise provides you with charts of real exchange rates transparently. That chart will show you what the fees will be for currency swaps and transfers.

-

Low remittance fee:

Most traditional banks and financial institutions often charge a hidden fee of up to 5% when you perform currency swaps and international transfers. In addition, both sender and receiver incur additional fees for the transfer.

Wise's fees are much cheaper than the traditional options above and everything is clear and transparent.

-

Wide scope

Currently, there are few platforms that are as broad as Wise. You can send money to 80 countries and in 50 different currencies.

Disadvantages of Wise

Of course, Wise also have their weaknesses, here are some to keep in mind:

- Slow money transfer

In fact, transferring money through Wise can be fast or slow but it all depends on how the money transfer is done. If the transfer is done through a bank account (instead of a card), the process can take several days or even more than a week. The reason for this delay is that it takes Wise time to receive your funds, convert and then send your money abroad.

PlutusPay has tested remittances in the UK, Germany and Portugal. On average, money transfers take about three days when made from a bank account.

- Phone support is quite limited

You can only contact the customer service team by phone during office hours of working days. While this is the norm for most financial institutions, it should also be mentioned.

Options when transferring money via Wise

- Transfer money through banks: Wise allows customers to transfer money from their bank account to a bank account in another country.

- Transfer money via debit or credit card: Wise allows customers to use their card to transfer money internationally.

- Using Apple Pay or Google Pay: Wise integrates with Apple Pay and Google Pay, making it easy for customers to send and receive money through their smartphones.

- Transfer money via local bank: In some countries, Wise supports money transfers through local banks, allowing customers to receive funds in that local currency without having to pay a foreign currency conversion fee.

- Transfer money via SWIFT: Wise supports money transfers through SWIFT, allowing customers to send money to more than 200 countries through the SWIFT network.

- Transfer money via ACH: Wise has an ACH transfer service in the US, allowing customers to send money to other US bank accounts.

- Direct payment: Wise allows customers to set up direct payments to pay bills or make monthly/yearly payments to other accounts.

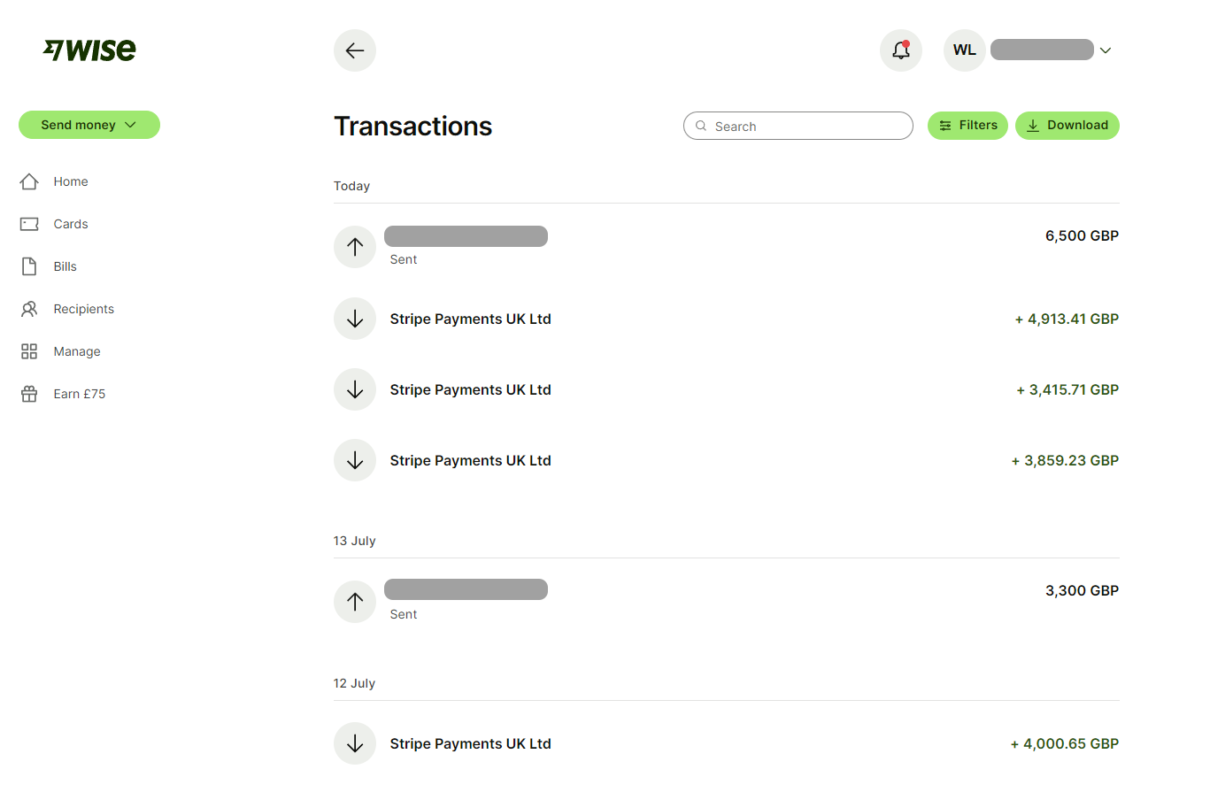

Transaction history of made transactions

How Wise ensures safety

Securing customer funds and personal information is one of Wise's top priorities. This company is licensed and regulated by financial authorities in all countries where it operates, including the UK's Financial Administration (FCA).

Wise uses two-factor authentication to protect user accounts and takes measures to prevent unauthorized access to their systems. Types of encryption are used to protect sensitive data, and regular security checks are conducted to identify and fix potential vulnerabilities in the system. With these strong protections, Wise is one of the safest and most reliable platforms for international money transfers.

Rates and fees when using Wise

Before using Wise to send money abroad, you should also understand how currency conversion works and the fees involved.

General fee

Wise uses the actual exchange rate for money transfers, rather than the travel exchange rate, so it's much cheaper. The fee is only from 1% to 2.5% for money transfer.

Other hidden fees

Are not Is there any hidden fee when you use Wise.

However, there will be fees added to the actual exchange rate. The difference is that Wise will transparently notify users of the fees involved on a line-by-line basis, unlike other financial institutions that often hide these charges.

Wise's business account

Wise Business Accounts and Debit Cards are a convenient solution for businesses that frequently make international money transfers and need an account that accepts multiple currencies. Because there are no monthly fees or minimum balance requirements, Wise business accounts are offered with a range of features designed to meet the needs of businesses. Features can include:

- Use all the features of Wise with only 1 payment of $31.

- Competitive exchange rates and low fees, plus transparency in international payments.

- Receive payments using local bank account information and withdraw funds from payment providers like Stripe.

- Add members to the account and decentralize user management.

- Make bulk payments up to 1,000 recipients in multiple currencies, with the click of a button.

- Compatible with cloud-based accounting services such as Xero and Quickbooks.

- API integration to automate workflows.

Wise Business is suitable for businesses of all sizes, from startups to large corporations with overseas employees, customers or suppliers.

Conclusion: Should I open an account at Wise?

If you often have to make international money transfers, the answer will be yes. However, there are also many records of Wise Suspending the account without informing why if they discovered anything suspicious in this account's activity. Therefore, when using Wise, everyone should limit the transfer and receipt of money from invalid sources to avoid immediate account lockout.

Wise is a great option for transferring money internationally. Wise benefits include ease of use, transparency, low costs, and excellent customer service. From the easy sign-up process to the efficient execution of money transfers, Wise delivers an outstanding user experience. Compared to the traditional money transfer model, you should use Wise now.