Currently, ACH transfer (ACH transfer) and Wire transfer (Wire transfer) are two different but very convenient ways to transfer money from one bank account to another. Each way has its own advantages and disadvantages, depending on your needs. In this article, PlutusPay will explain how ACH transfers and wire transfers work, look at the key differences between them, and help you understand in which situations they would be useful.

How does ACH transfer work?

Automated Clearing House (ACH) is an electronic payment network that allows consumers and businesses in the United States to pay directly from their bank accounts. Since this form is often processed in batches (Batch), ACH is very cost-effective and is used in many industries. This makes it ideal for routine payments between businesses (B2B).

ACH can be used for a variety of transactions, including Direct Debit, Deposit, Payment, Electronic Check and Electronic Transfer. It is a very popular payment method in the United States, with about 24 billion transactions processed annually.

How does Wire Transfer work?

Wire Transfer is a type of Electronic Transfer (EFT) that allows large amounts of money to be sent directly from one bank account to another without the need for an intermediary. This can be done locally or internationally (also known as a Remittance transfer), and can usually be sent and disbursed on the same day.

To make a Wire transfer, the recipient only needs to notify their bank of the amount to be sent, the deposit account number, the recipient's personal information and account number, and the routing number. ) (or SWIFT code for international transfers) of the recipient's bank. With this information, the bank can deduct the requested amount from the sender's account and transfer it to the receiver's account.

Source: Internet

Difference between ACH and Wire

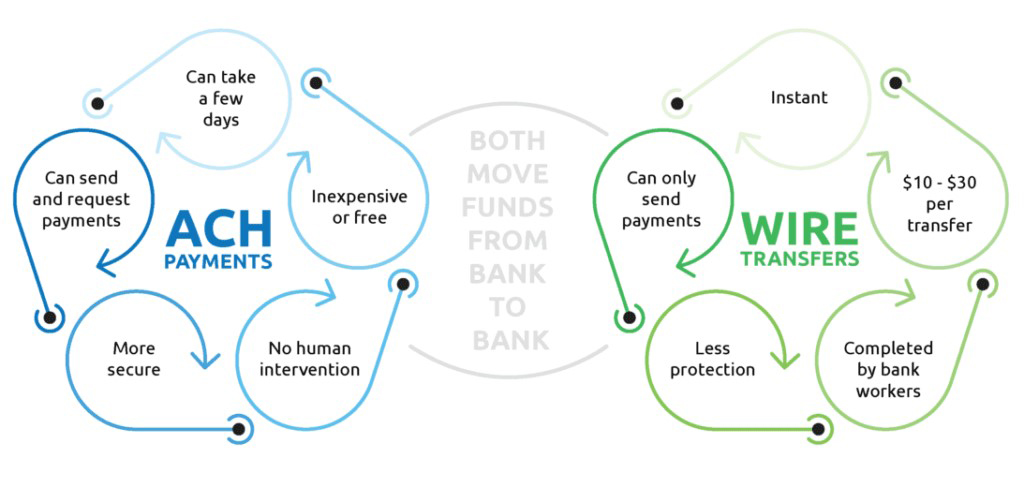

Both ACH and Wire transfer methods are being used by many people at the same time, but there will be differences between them in each specific case.

-

Expense

With ACH, usually the fee will not be much. In contrast, Wire can cost anywhere from $10-50 (depending on the bank and whether the payment is domestic or international), and both sender and receiver sometimes have to pay that fee.

-

Speed

Both ACH and Wire can be completed in the same business day, however Wire is usually processed faster and can be done immediately. This is because the ACH must be routed through the network and may be subject to internal audits. This process may take several days to complete. Meanwhile, Wire will be faster because it is transferred directly between financial institutions (Financial institutions).

-

Total value of money

Wire is often used for larger value transactions than ACH because funds are usually processed faster.

-

Payment Process

If something goes wrong, you can request a refund of your ACH transfer, although you will likely need to pay a few dollars to do so. In contrast, Wire transfers cannot perform this return action once the funds have been sent.

-

Waiting time

The receiver side of the Wire transfer can withdraw the money as soon as the amount is credited to the account. The receiver side of an ACH transfer usually has to wait several days for the funds to be disbursed in the ACH system.

Are ACH and Wire transfers safe?

Both Wire transfers and ACH transfers are secure ways to make payments. Both methods require identity verification and bank details, all of which are encrypted during the transfer, helping to protect your funds from commercial fraud.

However, due to the fast and non-refundable speed of Wire transfers, they are often considered riskier than ACH transfers. It is still possible to request a cancellation of a Wire transfer, but the sender must act very quickly to do so.

Is it possible to transfer ACH or Wire internationally?

Both ACH transfers and Wire transfers can be sent domestically and internationally, depending on the type of transaction.

- Wire Transfer is a good choice if you want to send a large international payment that can be sent in US dollars. This type of transfer is also accepted in more countries than ACH transfers.

- ACH transfers can be used for international payments of smaller value, however, they can only be transferred locally in the local currency. However, the fees for international ACH are much lower than for international Wire transfers.

Is ACH transfer or Wire better for B2B transactions?

So with the above, if you are a seller who needs to do B2B transactions, the question will be which type of transfer should be used?

This depends on the specific case, as both have their own strengths/weaknesses suitable for different use cases. For regular bill payments for different businesses, ACH transfers can be a good choice, as the network is designed to process Batch payments and has fees. much lower than Wire transfer.

For payments of larger value and made only once (For example, real estate purchase or merger & acquisition), the Wire transfer fee will then be negligible compared to the amount Transactions and businesses can benefit from much faster processing times for ACH transfers.

summary

Both ACH transfers and Wire transfers have their own advantages. Determining which method is best depends on your specific needs, the type of payment you are making.

In other words, Wire transfer will be the best choice if you need to make a high value urgent payment or, international money transfer. On the contrary, for domestic payments where you may be willing to wait a few days, ACH transfer will usually be more suitable in this case.