Bank Mercury was originally created specifically for startups and fintech companies. Their goal is to facilitate these businesses by providing completely free banking services, including Checking account and Saving account.

The platform of bank Mercury is partnered with Choice Financial Group and Evolve Bank & Trust to protect users' finances.

In this article, PlutusPay will learn and evaluate with you about Mercury bank and the features it brings.

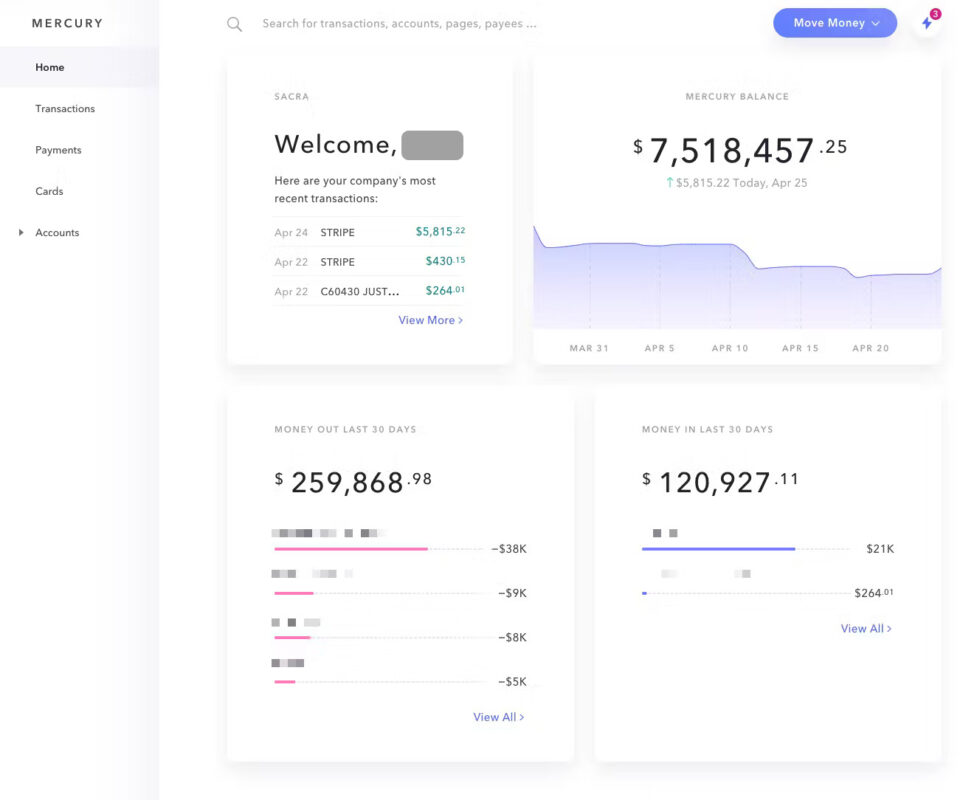

Source: Mercury

Definition of Bank Mercury

Mercury is a completely free online bank that offers users both a Checking account and a Saving account.

Mercury Bank Dashboard

Along with API support, comes with digitization tools and integrations, and especially at no cost, Mercury will be an ideal choice for current fintech businesses and startups. now.

Advantage:

- Low fees

- Provides a full range of Digital and Integration tools

- API connection supported

- Insured by FDIC

- Mercury Tea Room Program

- Free withdrawals at over 55,000+ ATMs

- Transfer money at home and abroad with more than 30 currencies.

- Profits up to 4,85% via Mercury Treasury

Defect:

- Cash deposits are not accepted.

- Individual business households and personal funds cannot open Mercury accounts

How Mercury Bank Works

Mercury is an online banking platform that works with FDIC-insured banks to protect your funds. At the same time, Mercury also offers its users a “Banking stack“with the goal of creating favorable conditions for startups to develop as well as simplifying banking for all other businesses.

One "Banking stack"aka"Banking Toolkit“, simply put it is a collection of financial and banking instruments, features and related accounts.

Mercury's banking toolset includes:

- One Checking account and one Saving account for business

- Business Debit Card

- Digital tools and integration

- Payment by check and ACH . transfer

- Domestic and international money transfer

Mercury business accounts provide your business with a range of digital and integration tools. They are fully compatible with Quickbooks and Xero, allowing you to automatically sync received transactions.

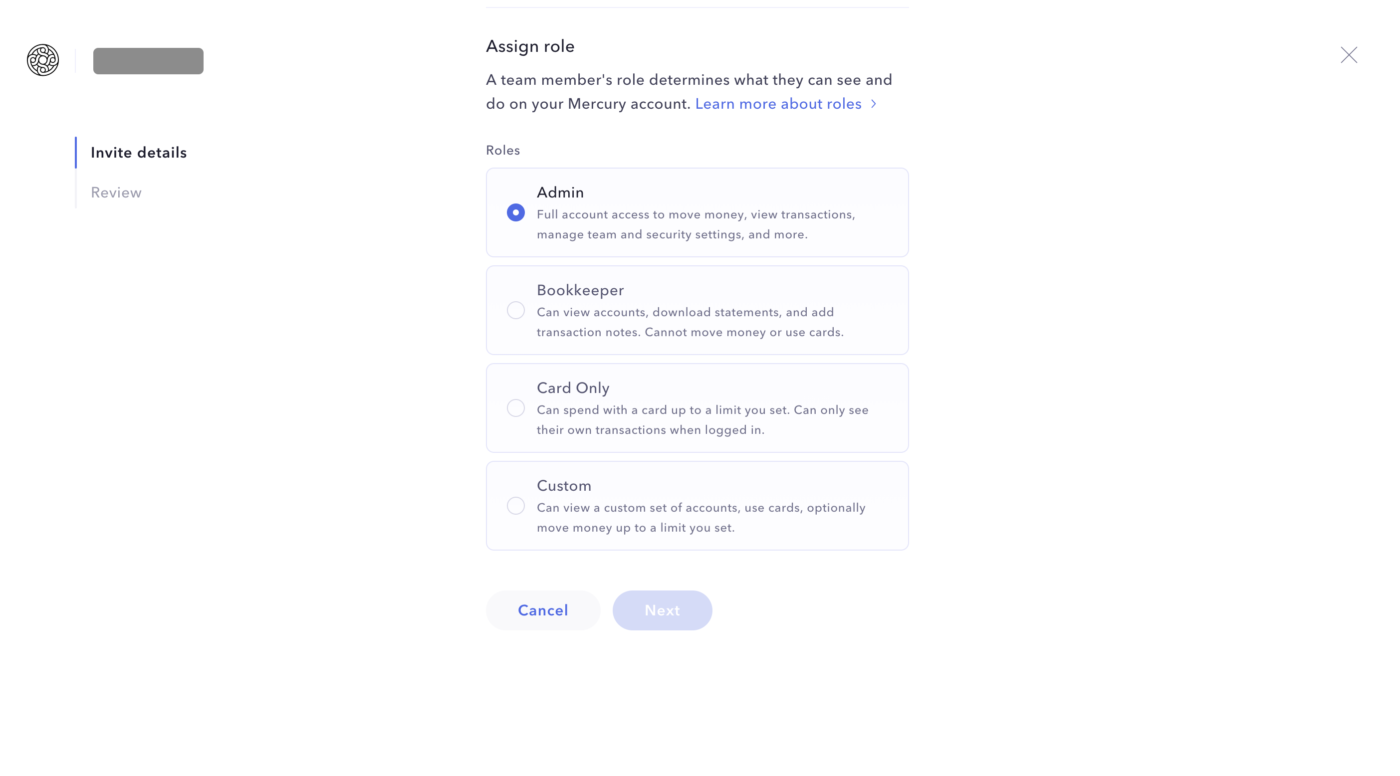

User Delegation in Mercury

In addition, you can invite any member to manage your Mercury account with you, and you can also control the level of access to each member's account through Mercury's decentralized system. . There are 4 main levels you need to note:

- Administrator (admin)

- Bookkeeper (bookkeeper)

- Customize access hierarchy (custom access)

- Only manage Debit cards provided (card only)

4 levels of user authority in Mercury

This makes Mercury Bank more flexible for startups when they want to be in control of their bank accounts. Furthermore, this also makes Mercury more suitable for any business that wants the same control and saves time on administrative tasks.

If your business has more than $250,000 in Mercury's business account, you'll be eligible to join the Mercury Tea Room.

Mercury Tea Room provides members with other benefits that regular members do not have, such as access to beta features and 409As, along with other perks.

How to register for a Mercury bank account

To register for a Mercury business account, you need the following information:

- Employer Identification Number (EIN)

- A photo of the identification, along with the official company incorporation documents.

Mercury supports any company incorporated in the US, meaning you don't have to be a US citizen or resident to open an account.

While Mercury is very supportive of individuals who are not US citizens, they will disqualify you if you are from one of the following countries:

Belarus, Burundi, Central African Republic, Congo, Democratic Republic of the Congo, Cuba, Iran, Iraq, North Korea, Lebanon, Liberia, Libya, Nicaragua, Pakistan, Russia, Somalia, South Sudan, Sudan, Syria, Venezuela, Yemen , and Zimbabwe

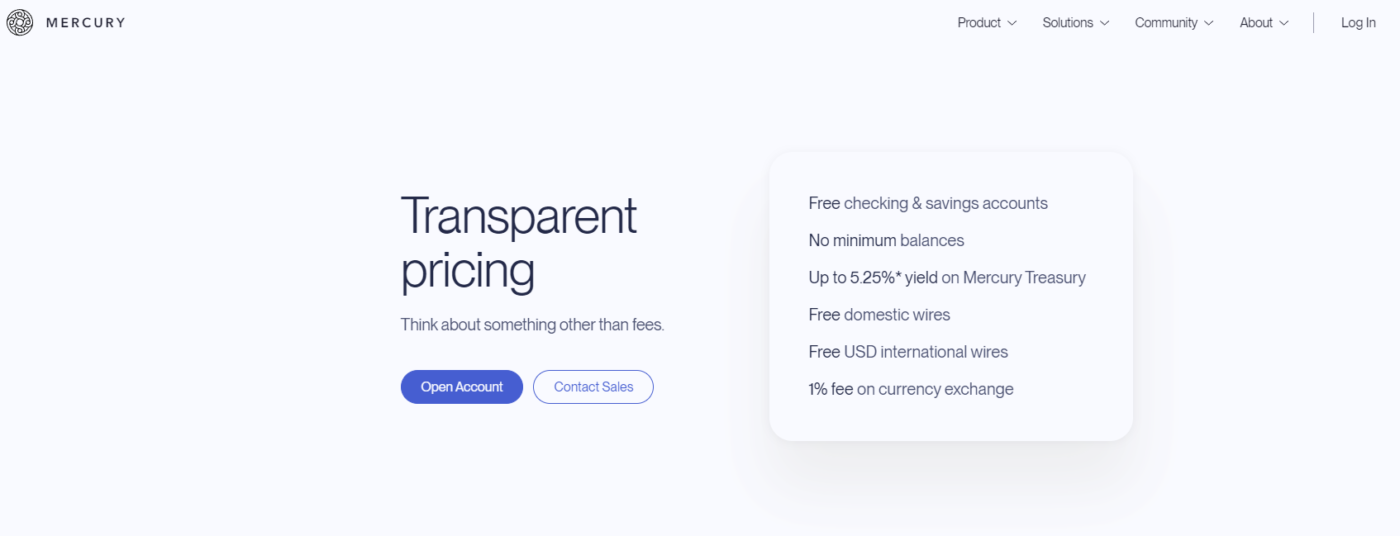

Mercury Bank Service Fee

A distinguishing feature of the Mercury bank is the fact that they do not charge any fees.

- Brothers There is no minimum fee to open an account, no minimum account balance requirements, no monthly maintenance fees, and no transaction fees.

- Similar, There are no overdraft fees and domestic and international money transfers in USD are completely free.

Mercury Bank only charges 1% for foreign currency conversion when you use a currency other than USD, as well as when you use capital management and mass payment services via API.

This makes Mercury Bank ideal for startups looking to save money and banking fees.

Mercury bank fees

Mercury Bank Payment Processing

Here is an overview of how Mercury Bank processes payments

Send money with Mercury

Mercury Bank supports domestic and international money transfers in more than 30 different currencies. In addition, you can also deposit and top up through payment checks.

In addition, you can also send payments through the Automated Clearing House (ACH) network for free when using Mercury banking.

Deposit cash in Mercury bank

At the time of writing Plutuspay, Mercury bank still does not support sending and receiving cash. This makes Mercury not an ideal choice if your business frequently has cash deposits.

Is it safe to use Mercury bank?

Mercury ensures that their users are well protected at all times. HTTPS connections are present on all pages of Mercury's website, ensuring a secure connection for all banking activities.

Similarly, all passwords are hashed or encrypted with bcrypt, the same goes for Mercury databases and sensitive information.

Additionally, Mercury uses a one-time password for two-factor authentication, instead of relying on other less secure channels like SMS. Mercury also commits to never storing your card information.

Additionally, Mercury participates in an annual third-party security audit to detect vulnerabilities in their systems.

Are Mercury bank accounts insured by the FDIC?

Most users will be pleased to know that all Mercury accounts are insured by the Federal Deposit Insurance Corporation (FDIC) along with a $250,000 limit.

Mercury is officially not a bank, but in fact a fintech company. Mercury works with FDIC-insured banks, such as Evolve Bank & Trust, which means your money is insured to FDIC standards.

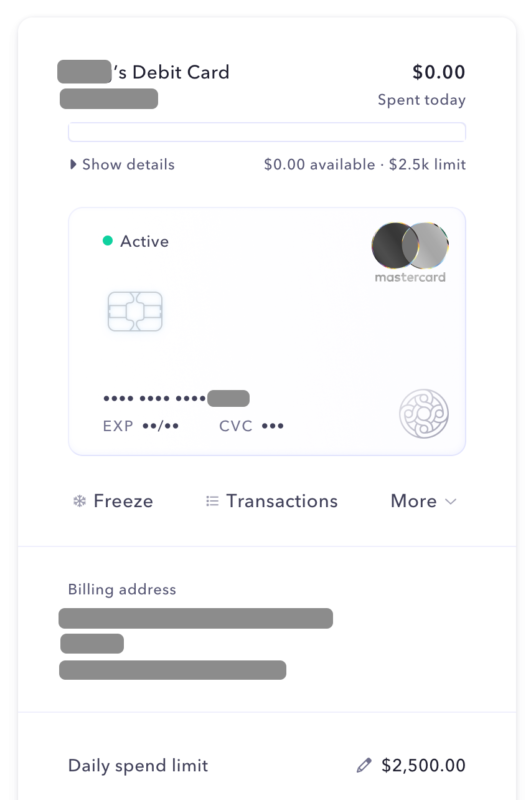

Mercury Bank Debit (debit) card

Once your Mercury business account is approved, you will receive a Mercury bank debit card.

If you don't want to wait for your physical card, you can create a virtual debit card for immediate use.

Debit card from Mercury bank

After activating Mercury's business debit card, you can use it at ATMs at no additional charge.

Similarly, the Mercury card is part of the Allpoint ATM network, which means Allpoint will not charge a withdrawal fee at any of its 55,000+ locations.

Mercury Bank API

All Mercury accounts come with an API access. This allows you to customize Mercury's banking software to your business needs, helping you to create custom dashboards, automate bulk payments and mediate transactions, and more. other function.

Mercury Bank's API is ideal for tech-savvy businesses, as well as for new startups.

Mercury App

Mercury has apps for both iOS and Android users. Currently, the Mercury Android app allows users to:

- View transaction history

- View account balance

- Edit card spending limit

- Freeze and unlock cards

- Store and view card information

The Mercury app for Android is under development new features, such as transaction search, will be available in the future.

Meanwhile, the Mercury iOS app is now getting more complete new features, such as transaction search, as well as the ability to transfer funds to and from linked bank accounts.