Recently, many individuals have become interested in online business in general and the Dropshipping method in particular, and have asked many questions related to payment gateways to PlutusPay. To help you learn about this issue effectively and save time, today PlutusPay will write an article to provide more detailed information about this issue.

In everyday transactions on the Internet, currency handling always involves a payment gateway. In Vietnam, because of the common habit of using cash, buyers often prefer the "receive first - pay later" (COD) method. Although this method seems safe because the buyer can check the product before paying, it brings many risks to the customer if the product has a problem after payment has been made.

In this situation, the seller already owns the money from the customer. If the customer wants to return the product, they must send the product back to the seller and wait for processing. At this point, the seller has the right to decide how to proceed, and this depends on their level of trustworthiness.

Therefore, there was a need for a service that receives money and guarantees the seller, regardless of geographical distance, and guarantees a refund to the customer if the seller does not meet the commitment. This is where one's role comes in payment gateways become prominent.

Source: Internet

Payment gateway definition:

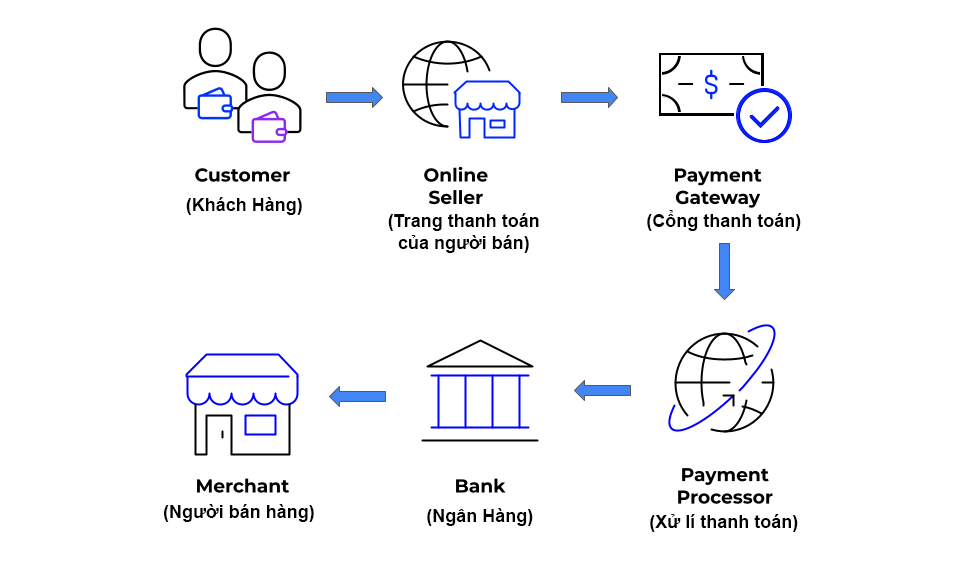

As an online intermediary service, a payment gateway allows transferring and receiving money over the internet from one user to another. It supports sellers in receiving money from any country (except those that do not allow it) through connecting to a bank account. Besides, it also ensures customers the fastest and safest payment, ensuring transparency through data storage and verification of the seller's origin.

Once the customer completes the transfer process, the funds will be held for a certain period of time on the portal before being transferred to the merchant. This is to verify the seller's commitments such as delivery time, product quality, type of goods, etc. Some portals do not place a hold on funds, which means they have previously placed a deposit on the seller. price and impose legal constraints on sellers in advance.

main fuction

- Receive payments through the website via payment gateway

- Process and verify payee information

- Refund money to sender if requirements are not met

- Transfer money to the recipient's bank account after successful processing

Classification of payment gateways

Currently, there are many different payment gateway services such as Paypal, Payoneer, 2Checkout, Stripe... and to understand how they work, you need to classify them based on processing principles. Based on this, PlutusPay can be temporarily divided into two types as follows:

Type 1: Payment gateway with redirection at checkout

One of the characteristics of this type of gateway is that when customers click on the payment button on the sales website, they will be redirected to the payment service provider (PSP) page. Here, customers will provide their payment information and after successful payment, they will be redirected back to your website to complete the payment process. Typical examples of such portals are: Paypal, 2Checkout.

Advantage:

- Safe and secure – This type of portal offers anti-fraud protections to ensure customer safety.

- Simple and convenient – Most users are familiar with this type of payment gateway and it is easy to set up and use.

- Easy registration – Merchants can easily register and use this payment gateway with little difficulty.

Defect:

- Waiting period – Because the service is intended to protect customers' interests, the seller must wait a certain period of time before receiving the money to use.

- Some customers with limited knowledge may feel uneasy when redirected to another website during the payment process.

Type 2: Payment gateway does not redirect during checkout

With this type of payment gateway, the merchant will receive payment on the same day and payment details will be collected from customers directly on your sales website. After the customer provides payment information, the data is encrypted and transmitted to the service provider. This means customers are not redirected to another website but can enter payment card information right on the sales page. A good example of this type of payment gateway is Stripe.

Advantage:

- Good customer experience – All transactions are completed in one place through payment gateways.

- Merchant control – Merchants have control over the payment process.

- Receive payments quickly – Merchants receive early payments directly from the portal.

Defect:

- Registration is difficult – Some portals only accept registrations from certain countries. For example, Stripe only operates in 26 countries such as the US, UK, France, Japan...

- Lack of technical support: Usually, these portals do not provide a technical support team. Therefore, when you encounter problems in the system, you will have more direct support.

Conclude

For international payments, popular payment gateways such as Paypal, 2Checkout and Stripe are still popular in Vietnam. But besides that, you should also register to use the Payoneer portal, another option for receiving and paying money.

If you are looking for a reputable and quality unit to rent a payment gateway, choose this service rent Stripe portal by PlutusPay. Our 24/7 support team will ensure your satisfaction.