Payment gateways are an important part of the eCommerce sector, helping online businesses and brick-and-mortar stores authorize and process credit and debit card payments.

Today, many businesses have switched from traditional payment methods such as bank transfers to using payment gateways because of the benefits they bring. One of the main benefits is the ability to make instant payments, which helps create trust for merchants and secure payment information. In addition, payment gateways also bring other benefits that traditional methods cannot have.

The following article by PlutusPay will analyze the advantages and disadvantages of each type of payment gateway:

Hosted payment gateways – Hosted payment gateways

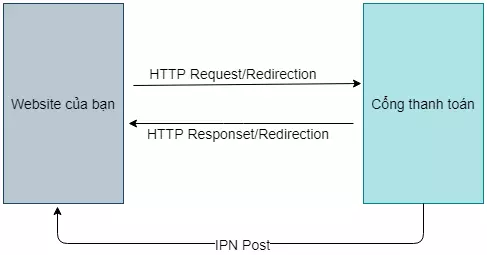

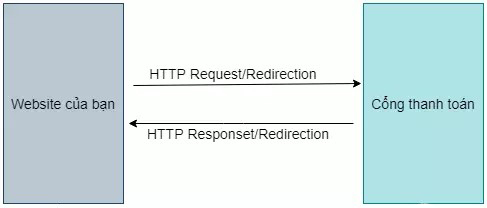

Is a type of payment gateway that allows customers to leave the checkout page directly on your website. When customers click the checkout button on your website, they will be redirected to the page that offers payment services (PSP). Here, customers will provide their payment information. Once the customer completes their payment, they will be redirected back to your website to complete the checkout process.

Another option is to use an iframe. PSP creates a form (iframe) that you insert into your website. This allows you to securely accept credit and debit card payments without collecting or storing card information on your website. Payment information is collected through a form (iframe) and stored by the PSP, so when a customer enters information into the form, the PSP receives that data.

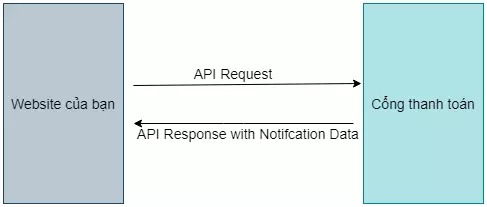

For recurring payments, a profile will be created for the customer with information about repetitions, frequency, amount, and other information. The payment gateway will automatically deduct recurring payments using the profile that has been created and then send payment notifications to your website.

Refunds and cancellations are made on the payment gateway's website.

A popular example of a hosted payment gateway is PayPal.

Advantage:

- Security: Cardholder details are securely protected by your payment service provider (PSP).

- Simple: Your PSP takes care of all the setup, letting you focus on running your business successfully.

- Customization: You can customize the checkout page by adding your logo, creating a special identity.

Defect:

- Customer Experience: You can't completely control the customer's final experience.

Self-hosted payment gateways – Self-hosted payment gateways

With this type of payment gateway, payment details are collected from customers on the merchant's website. After requesting payment details, the collected data is sent to the payment gateway URL. Some payment gateways require payment data to be provided in a specific format, while others require a hash or secret key.

In case of recurring payments, the payment gateway will automatically deduct and send notification of the same. The refund and cancellation process must be initiated from the Payment Gateway website.

Stripe and Shopify Payments are two of the most visible examples of self-hosted payment gateways.

Advantage:

- Easy Customization – Control your payments from start to finish and create a customer experience like on your website.

- Customer experience: Shoppers never leave your site, giving them more confidence to complete their purchase.

Defect:

- Security – Merchants must implement security measures to protect cardholder data.

API /Non Hosted Payment Gateways – Non-hosted payment gateways

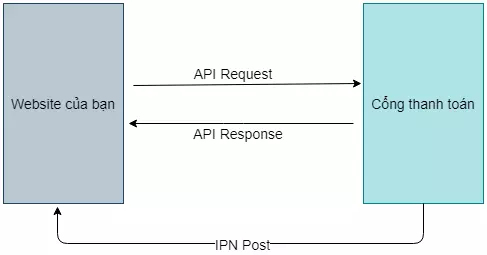

An API-based payment gateway allows customers to enter credit or debit card information directly on the merchant's checkout page, and payments are processed using an API (Application Programming Interface). ) or HTTPS queries.

With this type of payment gateway, customers enter card information directly on the merchant's checkout page and payment is processed via an API or HTTPS query.

Advantage:

- Flexibility: You have full control over your checkout page UI.

- Customer experience: Shoppers never leave your site, helping them feel more confident in completing their purchase.

- Flexibility: Using APIs, you can integrate your internet payment solution with any device connected to the internet (mobile phone, tablet, etc.).

Defect:

- Security: All responsibilities related to compliance with PCI DSS security standards are your responsibility.

- Services: Merchants may need to purchase an SSL certificate to increase the security of their sales page

Local bank integration - Local bank integration

Internal banking integration portals redirect customers to the payment gateway's website (bank's website), where they enter their payment and contact information. Once payment is completed, the customer will be redirected back to the merchant's website, and payment information will be sent through the redirection process. These types of payment gateways do not support recurring payments, refunds, and order cancellations.

For example: Bank Audi, Payseal

Advantage:

- Simple: Good choice for small businesses who need one-time payments.

Defect:

- Limitations: Lacks some basic features such as refunds to customers (Refund) and recurring payments.

Summary

Choosing a payment gateway depends on your business model, the features you need, and the level of control you want over your customers' payment experience.

For online businesses and wholesalers, a self-hosted payment gateway offers the smoothest experience, as it allows customers to complete transactions from a single page and gives merchants control over with customer experience.

If you are in need of a self-hosted payment gateway like Stripe or Shopify Payment for your business, contact us. PlutusPay does provide services Stripe payment gateway rental with attractive fees.